Generic drugs make up over 90% of all prescriptions filled in the U.S., but they’re also the source of nearly every drug shortage you hear about. You might not think much about a cheap antibiotic or a generic blood pressure pill-until it’s suddenly unavailable. Hospitals scramble. Doctors delay treatments. Patients go without. And the reason isn’t bad luck or a sudden spike in demand. It’s a broken system built on thin margins, global dependencies, and zero room for error.

Manufacturing Failures Are the #1 Cause

Over 60% of all drug shortages since 2011 have been caused by manufacturing problems, according to FDA data. This isn’t about minor glitches. It’s about contamination, equipment breakdowns, and quality control failures that shut down entire production lines. One single facility can supply a drug to millions of patients. If that plant gets flagged by regulators for unsanitary conditions-or worse, finds mold in a sterile injectable batch-production stops. No backup. No quick fix.

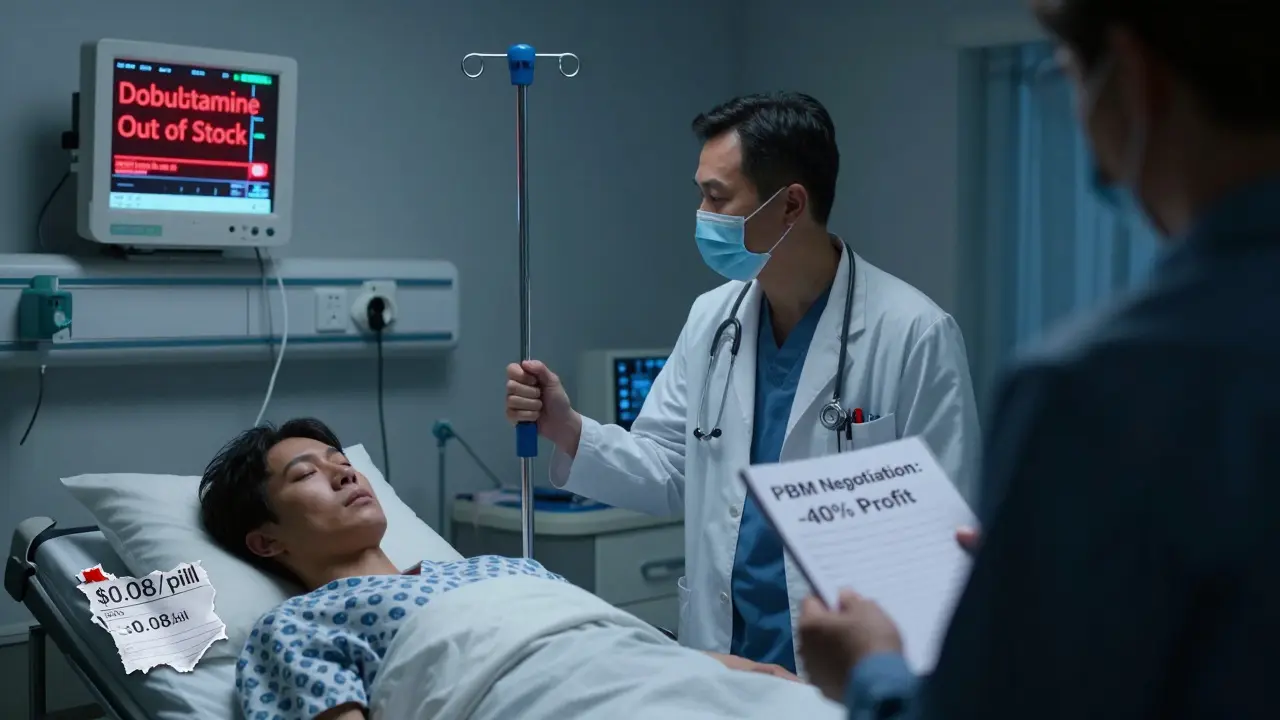

Take the case of sterile injectables like sodium bicarbonate or dobutamine. These are life-critical drugs used in emergency rooms and ICUs. A single contamination event at a facility in India or China can ripple across the entire U.S. supply chain. The FDA doesn’t just shut down a line-it shuts down the whole facility until every process is fixed, revalidated, and re-inspected. That process can take months. And during that time, hospitals are forced to ration what’s left or switch to less effective, more expensive alternatives.

Global Supply Chains Are a Single Point of Failure

Eighty percent of the active pharmaceutical ingredients (APIs) used in generic drugs come from just two countries: China and India. These aren’t just suppliers-they’re the backbone of the entire global generic drug market. But that concentration creates massive risk. A flood in India, a labor strike in China, or even a customs delay at a single port can disrupt supply to thousands of products.

It’s not just geography-it’s dependency. Many generic drugs are made by only one manufacturer. If that company stops producing it, there’s no one else to pick up the slack. One in five drug shortages are tied to sole-source products. And because generic drugs are low-margin commodities, few companies are willing to invest in duplicate facilities or backup production lines. Why spend $50 million building a second plant when you’re already barely breaking even on a $0.10-per-pill drug?

Profit Margins Are Too Thin to Sustain Reliability

Branded drugs can have profit margins of 30% to 40%. Generic drugs? Often less than 15%. And in many cases, even lower. That’s because pharmacy benefit managers (PBMs)-the middlemen who control access to insurance formularies-have consolidated power. Three PBMs now control about 85% of prescription drug spending in the U.S. They demand the lowest possible price, and manufacturers have to compete down to the penny.

The result? Manufacturers cut corners. They reduce staffing. They delay equipment upgrades. They skip costly quality audits to save money. Over time, this erodes reliability. A 2023 study found that nearly 3,000 generic products have been discontinued since 2010. Most weren’t pulled because they were unsafe-they were pulled because no one could make money on them anymore. And once a manufacturer exits a market, it’s nearly impossible to bring them back. The regulatory hurdles are too high, and the financial risk too great.

Low Inventory, No Buffer

Unlike other industries, pharmaceutical manufacturers don’t keep extra stock. They operate on a just-in-time model. Why? Because holding inventory costs money. Storage, tracking, expiration risk-all add up. So most companies produce only what’s needed for the next few weeks. That works fine when everything runs smoothly. But when a factory shuts down or a shipment gets stuck, there’s no cushion. No safety net.

This is especially dangerous for critical drugs like chemotherapy agents, anesthetics, or antibiotics. A delay of even a few days can force doctors to use less effective substitutes. In cancer care, switching a drug mid-treatment can reduce survival rates. In surgery, running out of anesthetic can cancel procedures. And there’s no easy way to ramp up production quickly. Building a new sterile injectable line takes years. Getting FDA approval for a new manufacturer takes 18 to 24 months.

Regulatory Gaps and Lack of Transparency

The FDA is required to track drug shortages, but it doesn’t always know why they happen. About one in four shortage reports don’t include a clear reason. Why? Because manufacturers aren’t required to explain. They’re not punished for staying silent. And when they do report, the details are often vague: “manufacturing issue” or “supply chain delay.” That makes it impossible for hospitals or regulators to plan ahead.

Compare this to Canada. Canadian health authorities work closely with manufacturers, wholesalers, and pharmacies. They maintain a strategic stockpile of critical drugs-not for bioterrorism, like the U.S. does, but for everyday shortages. They share data in real time. They coordinate responses. The U.S. has no equivalent system. There’s no national alert network. No coordinated inventory tracking. No legal requirement for manufacturers to notify the government before discontinuing a drug.

Why Doesn’t the U.S. Make More Drugs at Home?

You’d think bringing production back to the U.S. would solve this. But it’s not that simple. The cost to build a modern pharmaceutical manufacturing facility in the U.S. can exceed $200 million. And without guaranteed sales or price controls, no company will make that investment. The market doesn’t reward reliability-it rewards the lowest bid.

Even when the government tries to help, it’s often too little, too late. The RAPID Reserve Act, introduced in 2023, proposes creating a federal stockpile of critical generic drugs and offering tax incentives for domestic manufacturing. But without fixing the pricing structure, those incentives won’t matter. If a drug sells for $0.05 a pill, even a $10 million subsidy won’t make it profitable.

What’s Being Done-and What’s Not

The American Medical Association has started pushing back against PBMs that force hospitals to use drugs in short supply over ones that are available. Some states are experimenting with drug price transparency laws. The FTC is investigating PBM practices for antitrust violations. But these are all band-aids.

The real fix? Change the economics. Pay manufacturers enough to make generic drugs reliably. Reward companies that maintain backup capacity. Require manufacturers to report potential shortages six months in advance. Fund a national drug stockpile for routine shortages-not just emergencies. And force PBMs to stop penalizing hospitals for using drugs that are actually in stock.

Until then, shortages will keep happening. Not because of bad luck. Not because of a pandemic. But because the system is designed to fail.

Why are generic drug shortages so common compared to brand-name drugs?

Generic drugs have much lower profit margins-often under 15%-while brand-name drugs can earn 30% to 40%. That makes it harder for generic manufacturers to invest in quality control, equipment upgrades, or backup production. Brand-name companies also have exclusive rights for years, so they can charge higher prices and build in supply buffers. Generics are treated as commodities, not critical health products.

Can the U.S. fix drug shortages by making more drugs domestically?

Building more manufacturing plants in the U.S. would help, but only if the economic model changes. A single sterile injectable facility costs over $200 million to build. Without guaranteed prices or government contracts to ensure steady sales, no company will take that risk. Incentives alone won’t work unless they’re tied to long-term purchasing agreements.

How do pharmacy benefit managers (PBMs) contribute to drug shortages?

PBMs control about 85% of prescription drug spending in the U.S. They negotiate prices with manufacturers and decide which drugs go on insurance formularies. To get their drugs listed, manufacturers must offer the lowest possible price. This drives margins down, forcing companies to cut costs in manufacturing and quality control. Some manufacturers exit the market entirely because they can’t compete. PBMs also don’t disclose their pricing deals, making it impossible to track why certain drugs disappear.

Why don’t manufacturers just make extra stock to avoid shortages?

Storing extra inventory is expensive. Drugs expire. Storage requires climate control. Tracking batches adds administrative costs. In a low-margin business, holding extra stock eats into profits. Manufacturers operate on a just-in-time model because it’s cheaper. But that means zero buffer when something goes wrong-no spare parts, no backup production, no safety net.

Are drug shortages getting worse?

Yes. The number of drug shortages hit a peak in 2018 and remained high through 2020-2023, with over 300 new shortages reported each year. The pandemic exposed how fragile the system is. But even before COVID, the trend was clear: fewer manufacturers, lower prices, and less redundancy. Without major policy changes, shortages will keep increasing-not because of emergencies, but because the system is built to break.

If you’re a patient, you might feel powerless. But the problem isn’t your fault. It’s a structural failure in how we pay for and produce the most basic medicines. Real change won’t come from better communication or emergency alerts. It will come when we stop treating life-saving drugs like cheap commodities and start treating them like the public health infrastructure they are.

Sarah Williams

December 22, 2025 at 09:34

This hits way too close to home. My mom had to delay her chemo last year because the generic version was out. No warning. No backup. Just silence from the system.

It’s not about politics-it’s about people dying because we treat medicine like a commodity.