When you pick up your prescription, you might expect to pay the price listed on the bottle. But often, you’re handed a bill that’s higher than expected - and you didn’t even get a warning. That’s because your health plan doesn’t cover everything upfront. Instead, you share the cost through deductibles, copays, and coinsurance. These aren’t just confusing terms - they directly affect how much you pay for your meds each month.

What Is Cost Sharing?

Cost sharing is the part of your healthcare bill you pay out of pocket. It’s not your premium - that’s the monthly fee you pay just to have insurance. Cost sharing kicks in when you actually use care. For medications, this means you pay part of the price until your plan starts covering more. The goal? To keep premiums lower by making you share some of the risk. But if you don’t understand how it works, you can get hit with surprise bills - especially for chronic conditions or specialty drugs.Deductibles: The First Hurdle

Your deductible is the amount you pay each year before your insurance starts helping with most costs. For meds, that means you pay 100% of the price until you hit that number. If your plan has a $2,000 deductible, every pill, injection, or inhaler you buy this year comes out of your pocket. No discounts. No help from the plan. Some plans waive the deductible for preventive care - like annual check-ups or vaccines. But for most prescriptions, especially brand-name or specialty drugs, you’re on your own until you hit that number. A 2023 Kaiser Family Foundation report showed that the average individual deductible for marketplace plans was $1,500 for bronze plans and $5,000 for silver plans. That’s a lot of insulin, asthma inhalers, or blood pressure meds before your plan even chimes in.Copays: Fixed Fees at the Pharmacy

Once you’ve met your deductible, many plans switch to copays for prescriptions. A copay is a flat fee you pay each time you fill a prescription. It doesn’t change based on the drug’s price. For example:- Generic drug: $10 copay

- Brand-name drug: $40 copay

- Specialty drug: $100-$200 copay

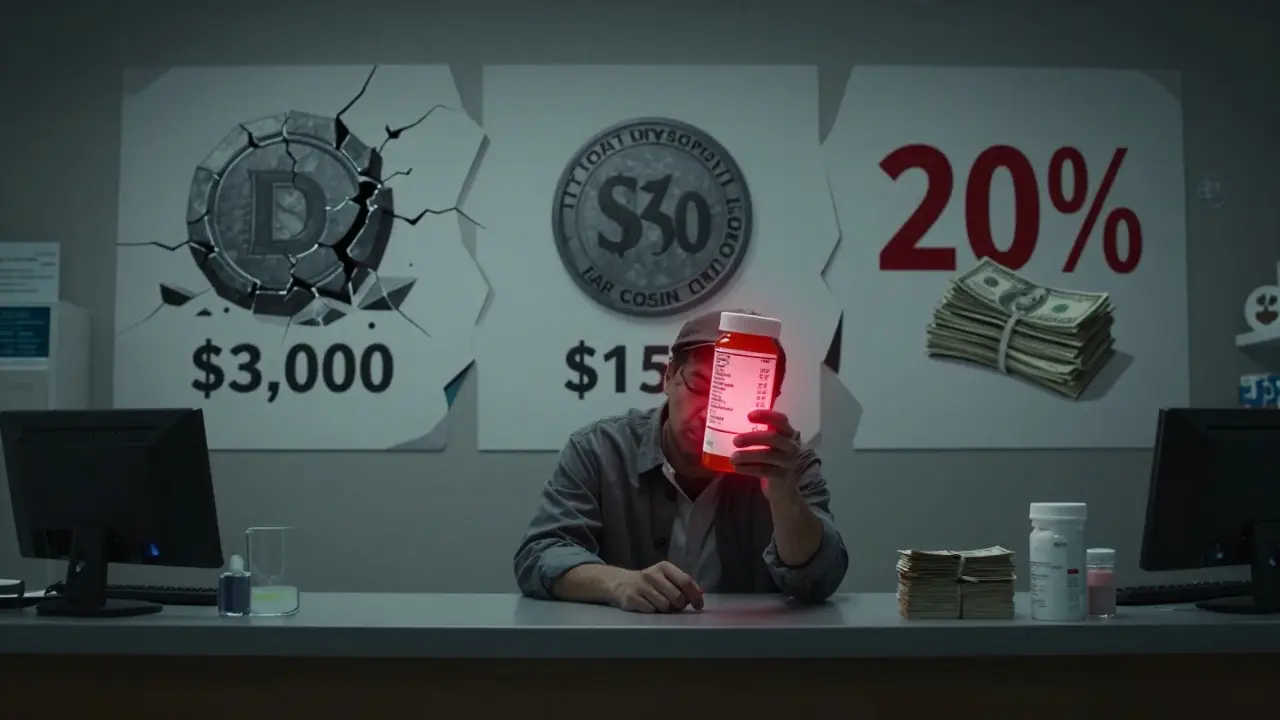

Coinsurance: The Percentage Game

Coinsurance is when you pay a percentage of the drug’s cost after you meet your deductible. Say your plan has 20% coinsurance for brand-name meds. The pharmacy bills your insurer $300 for your medication. After your deductible is met, you pay 20% of $300 - that’s $60. Your insurer pays the other $240. This can be dangerous if you don’t realize how it adds up. A specialty drug for rheumatoid arthritis might cost $8,000 a month. With 20% coinsurance, you’re paying $1,600 per month. Even if your deductible is met, that’s $19,200 a year - and that’s before you hit your out-of-pocket maximum. Compare that to a $100 copay. If your plan had a copay instead, you’d pay $100 a month - $1,200 a year. That’s a $18,000 difference. That’s why knowing whether your plan uses coinsurance or copays matters more than the premium you pay.Out-of-Pocket Maximum: Your Safety Net

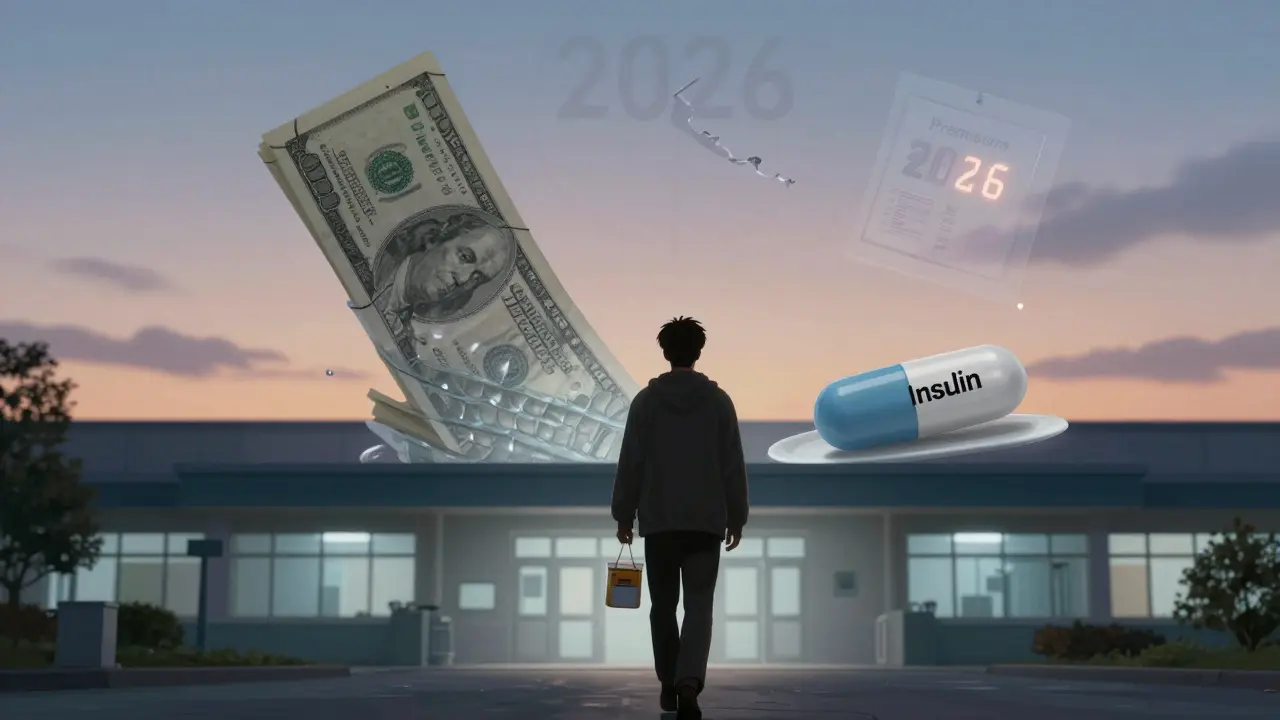

Every plan has a cap. Once you’ve paid a certain amount in deductibles, copays, and coinsurance during the year, your plan pays 100% of covered costs for the rest of the year. In 2026, the federal limit is $9,100 for individuals and $18,200 for families. This is your escape hatch. If you’re on a high-cost medication, you’ll likely hit this cap. But here’s the catch: only what you pay toward your deductible, copays, and coinsurance counts. Your monthly premiums? They don’t count. So if you pay $500 a month in premiums, that’s $6,000 a year you’re paying - and it doesn’t help you reach your out-of-pocket max. That’s why people on expensive meds often switch plans mid-year - not for the premium, but to find one with a lower coinsurance rate or a better copay structure.How It All Fits Together

Let’s say you have a $3,000 deductible, 20% coinsurance after that, and a $9,100 out-of-pocket max. You take a $1,200 monthly specialty drug. - Months 1-2.5: You pay full price - $3,000 total. Deductible met. - Months 3-10: You pay 20% of $1,200 = $240 per month. That’s $1,920 over 8 months. - So far, you’ve paid $4,920. - Months 11-12: You pay another $240 x 2 = $480. Total paid: $5,400. - You’re still far from the $9,100 max. - Next year? You start over. Now imagine the same plan had a $150 copay after deductible. You’d pay $150 x 12 = $1,800 for the year. That’s $3,600 less than coinsurance. That’s the power of knowing your structure.

What You Can Do Right Now

Don’t wait for a surprise bill. Take action:- Get your plan’s Summary of Benefits and Coverage (SBC). It’s required by law. Look for the section on “Prescription Drugs.”

- Check if your meds are on the formulary. If they’re not, ask your doctor for alternatives.

- Ask your pharmacist: “Is this covered under deductible, copay, or coinsurance?”

- Use your insurer’s online cost estimator. Most let you enter your drug and see your estimated out-of-pocket cost.

- Ask about patient assistance programs. Many drugmakers offer discounts for high-cost meds - even if you have insurance.

- Verify your pharmacy is in-network. Out-of-network pharmacies can charge you 50-100% more.

What’s Changing in 2026

The Inflation Reduction Act capped insulin at $35 per month for Medicare patients - a big win. But for private insurance, it’s still a free-for-all. Some insurers are starting to reduce coinsurance for high-value drugs - like those for diabetes or heart disease - while keeping it high for low-value ones. This is called value-based insurance design. It’s still rare, but it’s coming. Also, transparency rules are tightening. By 2026, insurers must show you your estimated cost-sharing amount before you fill a prescription - no more guessing.Bottom Line

Deductibles, copays, and coinsurance aren’t just fine print. They’re the real cost of your care. A low premium might look great - until you realize you’re paying $1,000 a month for your meds. Know your plan. Ask questions. Don’t assume. Your wallet - and your health - will thank you.Do copays count toward my deductible?

No, copays usually don’t count toward your deductible. They’re separate. You pay your copay at the pharmacy, but your deductible still needs to be met separately. However, coinsurance and payments toward your deductible do count toward your out-of-pocket maximum.

Can I avoid paying my deductible on prescriptions?

Only if your plan covers certain prescriptions before the deductible is met - which is rare. Most plans require you to pay full price until you hit your deductible. Some preventive medications (like birth control or certain vaccines) may be covered without meeting the deductible, but most prescription drugs are not.

Why is my coinsurance so high for specialty drugs?

Insurers use higher coinsurance for specialty drugs because they’re expensive. They assume you’ll use them less often, so they shift more cost to you. But if you need them regularly - like for rheumatoid arthritis or multiple sclerosis - this can become unaffordable. Always check if your plan has a cap on specialty drug coinsurance or if you qualify for manufacturer assistance programs.

Does my out-of-pocket maximum include my monthly premiums?

No. Your out-of-pocket maximum only includes what you pay for deductibles, copays, and coinsurance. Your monthly premiums are separate. That means you could pay $6,000 in premiums and still have to pay $9,100 more in out-of-pocket costs before your plan covers everything.

What if I can’t afford my coinsurance on a life-saving drug?

Contact the drug manufacturer. Most big pharmaceutical companies have patient assistance programs that can reduce or eliminate your cost-sharing. Nonprofits like the Patient Advocate Foundation can also help you apply for financial aid. Don’t skip doses - there are resources available.

Next time you pick up a prescription, ask yourself: Is this covered before or after my deductible? Is it a copay or coinsurance? And how close am I to my out-of-pocket max? These questions don’t just save money - they save your health.

Samyak Shertok

January 16, 2026 at 20:29

So let me get this straight - we pay premiums so we can be financially tortured by a system designed by people who think ‘out-of-pocket maximum’ is a motivational slogan? 🤡 I paid $1,200 last month for my thyroid med. My deductible? Met. My sanity? Gone. Welcome to American healthcare - where the only thing more expensive than the drugs is the illusion of choice.