When a drug first hits the market, its patent typically lasts 20 years from the date it was filed. But by the time it gets FDA approval, several years have already passed in clinical trials. That leaves maybe 10-12 years of real market exclusivity before generics can step in. So how do big drug companies keep selling a drug for 15, 16, even 20 years? The answer lies in formulation patents on drug combinations.

These aren’t the original patents that protect the active ingredient itself. Those are called composition-of-matter patents. Instead, formulation patents cover the how - the exact mix of drugs, the dosage ratio, the pill coating, the delivery method, or even the schedule you take them in. And they’re the main reason why a drug like Humalog, Nexium, or Phesgo stays off-limits to generics long after its core patent expires.

What Exactly Is a Formulation Patent?

A formulation patent doesn’t protect a new drug. It protects a new way of putting together drugs you already know. For example, imagine two drugs - Drug A and Drug B - that have been used separately for years. A company doesn’t invent either one. But they discover that giving them together in a 10mg:50mg ratio, in a once-daily tablet with a special slow-release coating, cuts side effects by 40% and boosts effectiveness by 30% compared to taking them separately.

That’s the kind of claim that gets a formulation patent. It’s not about the drugs. It’s about the combination. The ratios. The delivery system. The timing. And under U.S. patent law (35 U.S.C. § 103), you can’t just say, “We put two known drugs together.” The patent office expects you to prove it’s not obvious. That means you need hard data - clinical trials showing real, unexpected benefits.

Take Roche’s Phesgo®. It combines trastuzumab and pertuzumab - two drugs already used in breast cancer treatment - into a single subcutaneous injection. Before Phesgo, patients had to sit for hours getting IV infusions. Phesgo cut that to under 8 minutes. That wasn’t just convenient. It was a measurable improvement in patient outcomes and safety. That’s why the patent stuck. It wasn’t a gimmick. It was a meaningful change.

The Picket Fence Strategy

Big pharma doesn’t rely on one patent. They build a picket fence - a wall of overlapping patents around a single drug. You might have:

- A composition patent (the original, expiring first)

- A method-of-use patent (for treating a specific cancer subtype)

- A formulation patent (for a fixed-dose combo tablet)

- A delivery device patent (for an auto-injector)

- A dosage regimen patent (for once-weekly instead of daily)

This isn’t theoretical. According to the USPTO’s 2024 Drug Patent and Exclusivity Study, blockbuster drugs average 7-10 secondary patents. Each one adds a layer of protection. Even if one patent gets challenged and falls, the others hold. DrugPatentWatch found that 78% of new drug applications between 2015 and 2020 included at least one formulation or combination patent. That’s not an accident. It’s strategy.

How Long Does This Really Extend Exclusivity?

It varies. But the numbers don’t lie. On average, formulation patents extend market exclusivity by 3-8 years. For some drugs, it’s more. Eli Lilly’s Humalog insulin formulations gained up to 16 years of exclusivity through layered patents. AstraZeneca’s Nexium - originally just a proton-pump inhibitor - became a billion-dollar brand for over a decade thanks to multiple reformulations, even though the original patent expired. The company spent 7 years developing new formulations, but the payoff? $189 billion in cumulative revenue.

But here’s the catch: not every patent lasts. The USPTO found that 38% of formulation patents get invalidated - more than double the rate of primary patents. Why? Because courts are getting smarter. The 2007 KSR v. Teleflex Supreme Court decision made it harder to patent obvious combinations. If a generic company can show that combining two drugs in a certain ratio was already suggested in prior research, the patent crumbles.

Take Amgen’s Enbrel injector patent. They tried to patent a device that automatically delivered the drug via a pen-style injector. The court called it “obvious automation of manual injection.” The legal battle cost $147 million. The patent was thrown out.

Regulatory Levers: Exclusivity on Top of Patents

Patents aren’t the only tool. The FDA grants its own form of protection called regulatory exclusivity. It’s separate from patents and can stack on top of them.

- 5 years for a completely new chemical entity (NCE)

- 3 years for a new formulation, new indication, or new dosing regimen (if supported by new clinical data)

- 7 years for orphan drugs (for rare diseases)

The FDA reports that 42% of drugs approved between 2010 and 2020 got multiple layers of exclusivity. That means even if a patent expires, generics still can’t enter because the FDA won’t approve them until the exclusivity period ends. This is why some drugs stay off the market for years after patent expiry - not because of legal barriers, but because of regulatory ones.

The Dark Side: Evergreening and Product Hopping

This system isn’t without controversy. Critics call it “evergreening” - using minor tweaks to keep a drug monopolized. The Federal Trade Commission (FTC) says this practice inflates U.S. drug prices by 17-23% beyond what innovation justifies.

One tactic is “product hopping.” A company discontinues the original version of a drug - say, a tablet - and replaces it with a new version, like a capsule or an extended-release pill. Then they patent the new version. Patients and doctors are pressured to switch. But generics can’t copy it because the original version is no longer available. The FTC has 17 active investigations into this right now.

One example: oxaliplatin. A manufacturer stopped selling the original IV formulation and pushed doctors to use a new patented version. The FTC stepped in, calling it anti-competitive. The drug wasn’t better. It was just patented.

And not all formulation patents are created equal. The FDA’s Orange Book shows that 31% of combination patents between 2015 and 2022 covered trivial changes - like switching from one salt form to another or changing a filler in the pill. No clinical benefit. Just a patent.

Who’s Winning? Who’s Losing?

The top 10 pharmaceutical companies average 14.7 formulation patents per blockbuster drug. Smaller firms? Just 3.2. Why? Because it costs money - real money.

Merck’s IP director said at the 2023 BIO Convention that successful formulation patents require $28-42 million in extra R&D. That’s on top of the $2.6 billion average cost to develop a new drug. You need head-to-head clinical trials proving your combo is better - not just different. And you need p-values under 0.01. That’s not easy. Companies new to this strategy face a 62% rejection rate from patent examiners. Experienced players like Pfizer and Novartis? Around 31%.

Meanwhile, generics are fighting back. In 2023, generic manufacturers filed 842 Paragraph IV challenges against formulation patents - up from 517 in 2020. And they’re winning 45% of the time. Courts are now demanding real evidence of innovation, not just paperwork.

And Congress is watching. The proposed Preserve Access to Affordable Generics Act would force companies to prove “meaningful clinical benefit” before getting a new patent. If it passes, up to 28% of current formulation patents could be wiped out.

What’s Next?

The game is changing. Companies are moving beyond simple combo pills. Roche’s 2023 patent for a trastuzumab-deruxtecan combination with pH-sensitive release technology? That’s the new frontier. It’s not just combining drugs. It’s making them smarter - releasing only in the right part of the body, at the right time, to reduce toxicity and boost effectiveness. That kind of innovation is harder to challenge.

But the pressure is rising. The FDA proposed new rules in May 2024 requiring proof of clinical superiority for any new formulation seeking 3-year exclusivity. The USPTO is tightening obviousness standards. And public opinion is turning.

For now, formulation patents remain a powerful tool. They’ve extended exclusivity for hundreds of drugs, protected trillions in revenue, and kept generics at bay. But they’re no longer a free pass. The days of patenting minor tweaks are fading. The future belongs to combinations that deliver real, measurable, and provable improvements - not just legal loopholes.

Can a generic drug copy a combination product if the original patent expires?

No - not immediately. Even if the original composition-of-matter patent expires, formulation patents on the specific drug combination, dosage ratio, or delivery method can still block generics. Generic companies must either wait until those patents expire or design a non-infringing version - which often requires new clinical trials. This is why some drugs stay exclusive for over 15 years after their first patent.

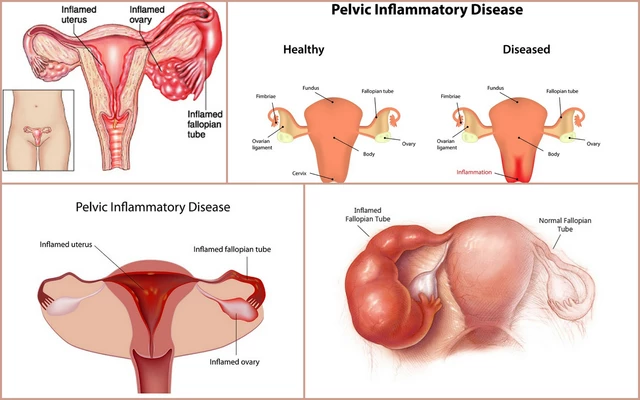

Are formulation patents only used in oncology?

No, but oncology is the biggest area. About 29% of formulation patents are in cancer drugs, followed by immunology (21%) and rare diseases (17%). That’s because combination therapies are common in these fields - where multiple drugs work better together. But formulation patents also exist for diabetes, heart disease, and psychiatric drugs. The key is whether the combination offers a clear, unexpected advantage.

Why do some formulation patents get rejected?

Most rejections happen because the combination is deemed “obvious.” If prior research already suggested using Drug A and Drug B together, or if the ratio used is common in practice, the patent office will reject it. Other reasons include insufficient clinical data, lack of unexpected results, or poor claim drafting. The USPTO says 37% of rejections are due to weak written description - meaning the patent didn’t clearly explain how the formulation works.

Do formulation patents increase drug prices?

Yes - significantly. Studies from the Congressional Research Service and the FTC estimate that evergreening through secondary patents raises U.S. drug prices by 17-23%. When generics are delayed by 4-5 years, patients pay more. In some cases, a brand-name drug costs 10 times more than its generic equivalent. That’s why regulators are pushing for proof of real clinical benefit before granting new patents.

How can a generic company challenge a formulation patent?

They file a Paragraph IV certification under the Hatch-Waxman Act, claiming the patent is invalid or won’t be infringed. This triggers a 45-day legal window where the brand company can sue. If the case goes to court, the generic must prove the patent is obvious, lacks novelty, or was improperly granted. Success rates are rising - 45% of challenges succeed now, up from 32% in 2020. Courts are increasingly siding with generics when patents cover minor changes.

Vamsi Krishna

February 11, 2026 at 21:41

Let me break this down like I'm explaining it to my cousin back in Hyderabad - these pharma giants aren't innovating, they're playing chess with patents. You take two drugs that've been around since the 90s, slap 'em in a pill with a fancy coating, call it 'novel delivery,' and suddenly you get another 12 years of monopoly? That's not science, that's legal graffiti. I've seen generics from India that work just as well, but they're blocked because some lawyer wrote 'pH-sensitive release' in a 30-page doc. This isn't capitalism - it's feudalism with a white coat.