When you fill a prescription for high blood pressure or cholesterol, you might not think about why your copay is $5 instead of $50. The reason isn’t magic-it’s insurance benefit design. Health plans and pharmacy benefit managers (PBMs) have spent decades building systems that push patients toward generic drugs, not because they’re less effective, but because they’re dramatically cheaper. And it’s working. In 2022, 91.5% of all prescriptions filled in the U.S. were generics, yet those same drugs accounted for just 22% of total drug spending. That’s the power of smart benefit design.

How Generics Save Billions-And How Plans Make It Happen

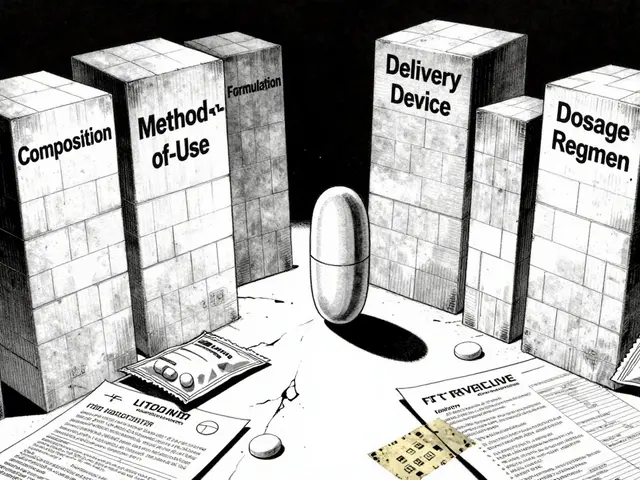

Generic drugs aren’t knockoffs. They’re FDA-approved copies of brand-name medications, proven to work the same way, with the same active ingredients, strength, and dosage. The difference? Price. Generics typically cost 80-85% less than their brand-name equivalents. A 30-day supply of a brand-name statin might run $120. The generic version? $10. That’s why health plans don’t just encourage generics-they engineer their benefits around them. The most common tool is the tiered formulary. Think of it like a pricing ladder. Tier 1 is where generics live-often with $0 to $10 copays. Tier 2 is for preferred brand-name drugs, usually $25-$50. Tier 3? Non-preferred brands, sometimes $60 or more. Some plans even have Tier 4 for specialty drugs, where copays can hit $200+. The message is clear: go lower on the ladder, pay less. But it doesn’t stop there. Most plans also use mandatory generic substitution. If a generic exists for your medication, your pharmacist can swap it in without asking your doctor-unless you or your doctor specifically opt out. All 50 states allow this. In 2023, 92% of Medicare Part D plans required patients to try a generic before approving a brand-name drug. That’s called step therapy, and it’s now standard practice.Who’s Winning? Who’s Losing?

On paper, this system looks like a win-win. Patients pay less. Insurers save billions. The U.S. healthcare system saved $3.7 trillion on generics between 2013 and 2022, according to IQVIA. That’s more than the entire GDP of Australia. But not everyone feels the savings. A 2022 study from the USC Schaeffer Center found many patients are paying more than they should for generics-not because the drug is expensive, but because of how PBMs handle pricing. Here’s the hidden part: when a plan pays a pharmacy $15 for a generic, the PBM might charge the insurer $25. The $10 difference? That’s called spread pricing, and it often stays with the PBM, not the patient. Even worse, some plans use copay clawbacks. You pay your $5 copay, but the PBM later refunds part of it to the pharmacy, leaving you with a higher out-of-pocket cost than expected. A 2024 Department of Labor report found patients were overpaying by $10-$15 per generic prescription because of these practices. That’s not a small amount when you’re filling three or four prescriptions a month.How Different Plans Handle Generics

Not all insurance plans are built the same. Medicare Part D, which covers over 50 million seniors, uses standardized formularies but still varies widely in out-of-pocket costs. In 2024, generic copays ranged from $0 to $15 across different plans. Medicaid, which covers low-income Americans, achieved an 89.3% generic dispensing rate in 2022-slightly higher than commercial plans. That’s because Medicaid has federal caps on how much states can pay for generics, forcing pharmacies to accept lower prices. Commercial insurers have taken it further. Nearly 31% of employer-sponsored plans now use high-deductible health plans (HDHPs) paired with Health Savings Accounts (HSAs). In these plans, generic drugs often have $0 copays-even before you meet your deductible. That’s because employers know: if patients pay less upfront, they’re more likely to take their meds, avoid hospital visits, and stay healthy. Self-insured employers-companies that pay for their employees’ healthcare directly instead of buying insurance-have been the most aggressive. A Johns Hopkins study found two large self-insured employers saved 9-15% on drug costs by switching patients to generics, with zero drop in health outcomes.

The Rise of Direct-to-Consumer Models

A new player is shaking things up: the Mark Cuban Cost Plus Drug Company (MCCPDC). Launched in 2022, it sells generic drugs at transparent, cost-plus prices-no middlemen, no spreads, no hidden fees. For 124 generics available as of May 2023, patients saved a median of $4.96 per prescription. For uninsured people, that’s a game-changer. But for Medicaid or Medicare beneficiaries? No savings. Why? Because those programs already pay below-market rates, and MCCPDC can’t undercut them. Still, it’s forcing PBMs to rethink their model. If patients can buy a 30-day supply of metformin for $4 instead of $15 through their insurance, why would they stay?What Patients Are Really Experiencing

Reddit threads and patient forums tell a mixed story. On r/healthinsurance, a May 2024 post asking if anyone else had their generic copay drop to $0 got 142 comments. Eighty-seven percent said yes-and were thrilled. But 13% reported being denied access to certain generics because their plan’s formulary didn’t include them. Others described being switched to a generic that caused side effects they hadn’t had on the brand-name version. A Kaiser Family Foundation survey from January 2024 found 68% of Medicare Part D users were satisfied with their generic coverage. But 22% had trouble getting prior authorization for brand-name drugs when generics were available. Fourteen percent said their doctors had to appeal multiple times just to get the medication their patient needed. And then there’s the confusion. Only 38% of Medicare beneficiaries understood how their plan’s generic coverage actually worked in 2023. That’s not just a knowledge gap-it’s a financial risk.

The Future: More Transparency, Less Mystery

The tide is turning. Starting January 1, 2025, insurers must include detailed breakdowns of drug pricing on Explanation of Benefits (EOB) statements. That means you’ll finally see what the PBM paid the pharmacy, what you paid, and what the insurer paid. No more guessing. The Inflation Reduction Act also introduced a $2,000 annual out-of-pocket cap for Medicare Part D drugs in 2025. That’s good news for seniors-but it changes the math. If you’re paying less out of pocket, do you still care if your plan pushes you toward generics? Maybe not. That’s forcing insurers to rethink their incentives. And then there’s the GENEROUS Model, set to launch in 2026. CMS is testing a new way to cut Medicaid drug spending by negotiating directly with manufacturers and standardizing coverage rules across states. If it works, it could save $40 billion over ten years.What You Can Do

You don’t have to be a policy expert to benefit from this system. Here’s how to take control:- Always ask if a generic version is available-your doctor might not know.

- Check your plan’s formulary before filling a prescription. Most insurers have online tools.

- If your copay seems high for a generic, call your pharmacy. Ask: “What’s the cash price?” Sometimes paying out-of-pocket is cheaper than using insurance.

- Review your EOB statements starting in 2025. Look for spread pricing or clawbacks.

- If a generic made you feel worse, tell your doctor. Therapeutic substitution isn’t always safe.

Bottom Line

Generic drugs are one of the most powerful tools in healthcare cost control. They’ve saved trillions, kept millions on their meds, and kept premiums from skyrocketing. But the system isn’t perfect. PBMs, insurers, and pharmacies still hold too much control over pricing-and too many patients are paying more than they should. The goal isn’t to eliminate generics. It’s to make sure the savings actually reach you.Are generic drugs as safe and effective as brand-name drugs?

Yes. The FDA requires generic drugs to have the same active ingredients, strength, dosage form, and route of administration as the brand-name version. They must also prove bioequivalence-meaning they work the same way in the body. Most generics are manufactured in the same facilities as brand-name drugs. The only differences are in inactive ingredients (like fillers or dyes), which rarely affect how the drug works.

Why is my generic drug copay higher than expected?

You might be hitting a copay clawback or spread pricing. Your plan may have paid the pharmacy $10 for the generic, but charged you $15. The $5 difference goes to the pharmacy benefit manager (PBM), not you. Starting in 2025, your Explanation of Benefits (EOB) must show this breakdown. If it doesn’t, call your insurer. You may be overpaying.

Can my pharmacist switch my brand-name drug to a generic without my doctor’s permission?

Yes, in 49 states, pharmacists can substitute a generic for a brand-name drug unless the prescriber writes “dispense as written” or “no substitution.” This is legal and common. But if you’ve had bad reactions to generics before, tell your doctor and pharmacist. You can always opt out.

Why does my insurance plan require me to try a generic before approving a brand-name drug?

This is called step therapy, and it’s used to control costs. Plans assume generics work just as well, so they make you try them first. If the generic doesn’t work or causes side effects, your doctor can file an appeal. Over 90% of Medicare Part D plans use this approach. It’s not meant to deny care-it’s meant to reduce unnecessary spending.

Should I use a direct-to-consumer pharmacy like Mark Cuban’s instead of my insurance?

If you’re uninsured or pay high out-of-pocket costs, yes-especially for expensive generics. For Medicare or Medicaid patients, it usually doesn’t help, because those programs already pay below-market prices. Always compare the cash price at a direct pharmacy with your insurance copay. Sometimes, even with insurance, paying cash is cheaper.

Do generics cause more side effects than brand-name drugs?

Rarely. Most side effects come from the active ingredient, which is identical in both. But some people are sensitive to inactive ingredients like dyes or fillers. If you notice new symptoms after switching to a generic, tell your doctor. You may need to switch back or try a different generic manufacturer.

How do I find out which generics my plan covers?

Check your plan’s formulary online-it’s a list of covered drugs and their tiers. Most insurers publish this annually. Look for the “Preferred Drug List” or “Formulary Guide.” If you can’t find it, call customer service and ask for the current formulary for your specific plan. Don’t assume your doctor knows what your plan covers-ask both.

Declan Flynn Fitness

December 2, 2025 at 17:02

Generic drugs are the unsung heroes of modern healthcare. I’ve seen patients on statins, metformin, and lisinopril switch from brand to generic and not even notice a difference-except in their bank accounts. Pharmacies love this too, because it means fewer returns and fewer complaints. The real win? People stay on their meds because they can afford them. That’s the whole point.