When you’re on Medicare and need prescriptions, understanding how generic drugs work under Part D can save you hundreds - even thousands - of dollars each year. Most people don’t realize that 92% of all prescriptions filled through Medicare Part D are generics. That’s not just a statistic; it’s your key to lower out-of-pocket costs. But knowing which generics are covered, how much you’ll pay, and how to avoid surprises isn’t automatic. It takes knowing how the system is built - and how to use it.

How Medicare Part D Formularies Are Structured

Every Medicare Part D plan has a formulary - a list of drugs it covers. This isn’t random. It’s carefully designed to push you toward the most affordable options. The formulary is split into five tiers, and generics mostly live in the first two.- Tier 1: Preferred generics - These are the cheapest. You’ll often pay $0 to $15 for a 30-day supply. Most common meds like lisinopril, metformin, or atorvastatin fall here.

- Tier 2: Non-preferred generics - Still generic, but slightly more expensive. Copays might be $20 to $40, or you might pay 25-35% of the drug’s cost as coinsurance.

- Tiers 3-5 - These are for brand-name and specialty drugs. Generics rarely appear here unless they’re new or high-cost.

What You Pay for Generics in 2025

The cost structure changed dramatically on January 1, 2025, thanks to the Inflation Reduction Act. Now, there’s a hard cap: you pay no more than $2,000 out of pocket for all your drugs in a year. That includes generics and brands. Once you hit that number, your drugs are free for the rest of the year. Here’s how it breaks down:- Deductible - $615 in 2025. Some plans have $0 deductibles, especially if you’re on a low-income subsidy.

- Initial coverage phase - After the deductible, you pay 25% coinsurance for generics. The plan pays 75%. This is where most people spend the bulk of their money.

- Catastrophic coverage - Once you hit $2,000 out of pocket, you pay nothing. Not even a copay. Medicare covers everything.

Why Generics Cost So Much Less

Generic drugs aren’t cheaper because they’re lower quality. They’re the same active ingredients as brand-name drugs, approved by the FDA, and just as safe. They’re cheaper because they don’t need to recoup billions in research and marketing costs. In 2023, generics made up 92% of Part D prescriptions but only 18% of total spending. That’s the power of this system. For example:- Brand-name Lipitor (atorvastatin) might cost $150/month before generics.

- Generic atorvastatin? $4-$12/month, depending on your plan.

How Plans Decide What Generics to Cover

Each Part D plan has a Pharmacy and Therapeutics (P&T) Committee. At least half of its members must be practicing doctors or pharmacists. They review clinical data, cost-effectiveness, and patient outcomes to decide which generics make the list. They’re not just picking the cheapest. They’re looking for:- Proven effectiveness

- Consistent quality from manufacturers

- Availability of multiple options in the same class

Common Problems With Generic Coverage

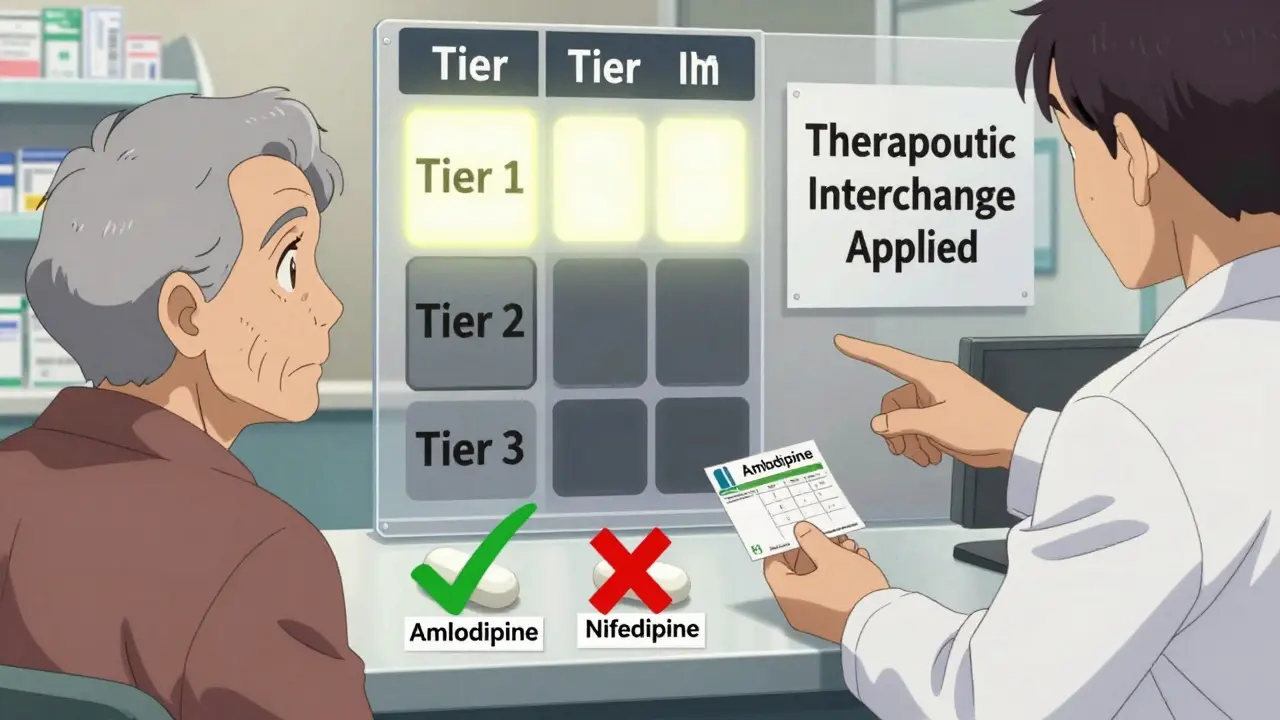

The system works well for most people - but not all. Here are the top complaints:- Therapeutic interchange - Your plan covers one generic for high blood pressure but not another. Your pharmacist tries to swap them, but you’re allergic to the filler in the substitute. Now you’re paying full price.

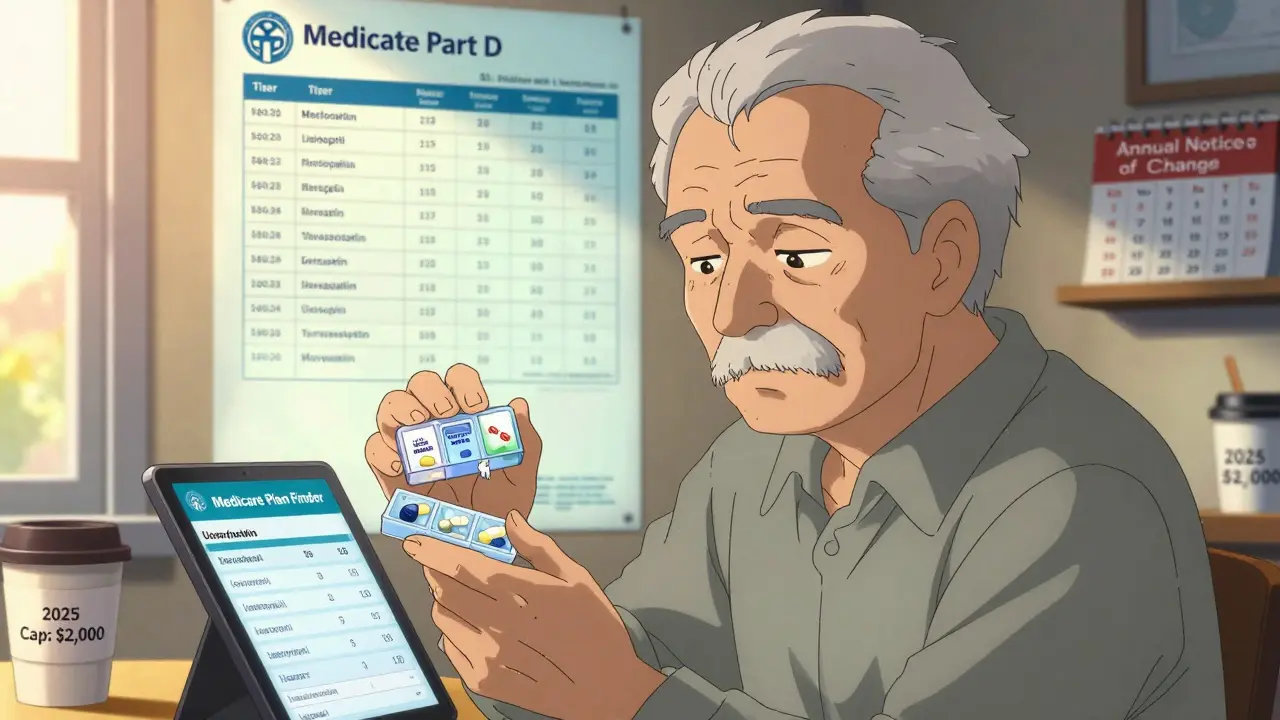

- Formulary changes - Every fall, plans send out an Annual Notice of Change. 37% of them change at least one generic’s tier. You might wake up one January to find your $5 generic is now a $40 one.

- Authorized generics - These are brand-name drugs sold under a generic label by the same company. They’re not always covered the same way. Some plans treat them like brands. Others treat them like generics. Confusing.

How to Protect Yourself

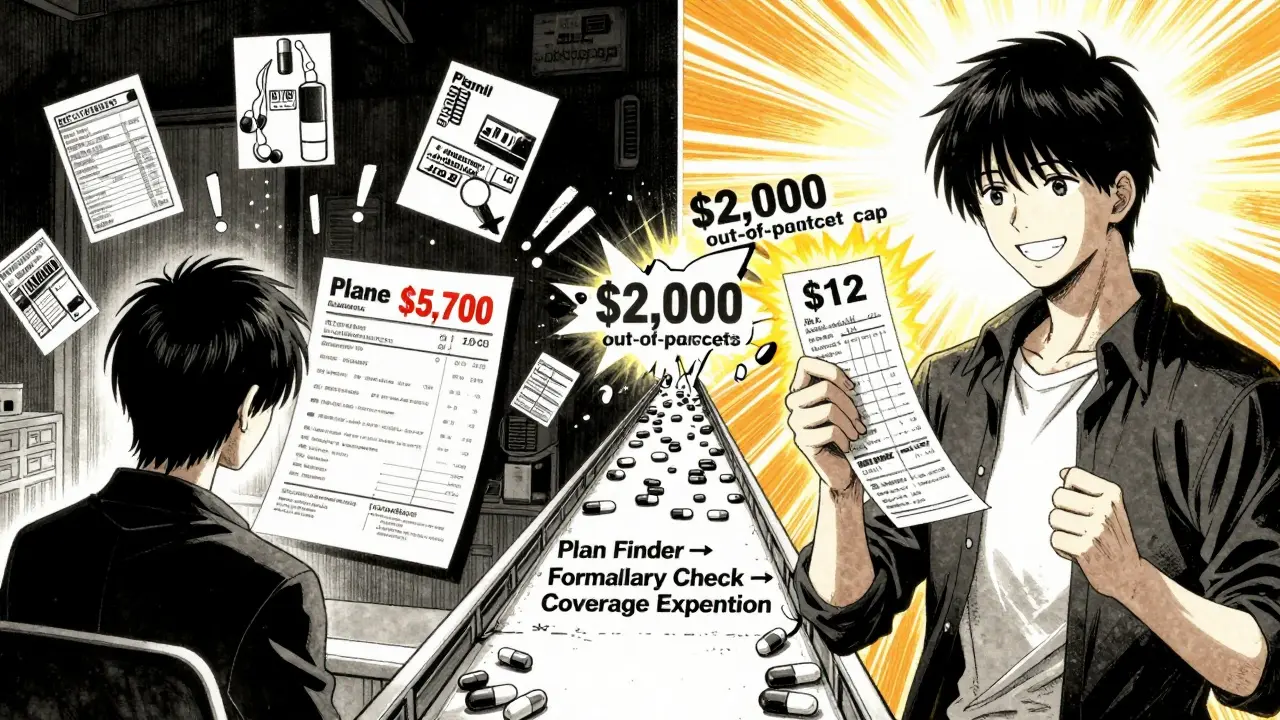

You don’t have to guess. Here’s how to take control:- Use the Medicare Plan Finder - Enter your exact medications, including generic names. Filter by “lowest total cost.” Don’t just pick the cheapest monthly premium - that’s a trap.

- Check the formulary before enrolling - 28% of people pick the wrong plan because they didn’t verify coverage. Use the “Formulary Finder” tool on Medicare.gov.

- Review your Annual Notice of Change - It arrives every fall. If your generic moved up a tier or got dropped, you have a window to switch plans.

- Request a coverage determination - If your generic isn’t covered, ask your plan for an exception. 83% of these requests are approved, especially if your doctor writes a letter explaining why you need that specific one.

- Choose a $0 deductible plan - If you take multiple generics, 52% of stand-alone Part D plans offer $0 deductibles. That means you start saving from day one.

What’s Changing in 2026 and Beyond

The changes aren’t over. Starting in 2026:- Plans must include a “generic price comparison tool” in their member portals. You’ll be able to see which generic in your class costs the least - right on your phone.

- The out-of-pocket cap rises to $2,100.

- Insulin glargine (generic Lantus) will be the first generic drug subject to Medicare price negotiation. That means its price could drop even further.

- By 2027, 95% of beneficiaries will have access to $0 copays for at least half of their commonly used generics - up from 78% today.

Real Savings, Real Impact

A 72-year-old in Ohio takes three generics: metformin, lisinopril, and atorvastatin. Her plan has Tier 1 coverage for all three. Her monthly cost: $12. Before Medicare Part D, she paid $480 a month out of pocket. That’s $5,700 saved a year. She didn’t get lucky. She used the Plan Finder. She checked her formulary. She asked for a coverage exception when one drug was dropped. She didn’t assume anything. That’s the difference between guessing and knowing.Generic drugs are the backbone of Medicare Part D. They’re safe, effective, and affordable - if you know how to use the system. Don’t wait for a surprise bill. Review your plan every fall. Know your meds. Ask questions. The savings aren’t hidden. You just have to look for them.

Are all generic drugs covered under Medicare Part D?

No. Each Part D plan chooses which generics to cover, but they must offer at least two options in each drug class. Plans can exclude certain generics, especially if they’re newer or less commonly used. Always check your plan’s formulary before enrolling.

Why is my generic drug not covered even though it’s the same as another one my friend takes?

Different plans cover different generics, even if they’re chemically identical. For example, your plan might cover amlodipine but not nifedipine - both treat high blood pressure. This is called therapeutic interchange. If you need a specific generic, request a coverage exception with a letter from your doctor.

How does the $2,000 out-of-pocket cap work for generics?

Once you’ve spent $2,000 out of pocket on all your drugs in a year (including generics and brands), you enter catastrophic coverage. After that, you pay $0 for all covered medications for the rest of the year. Only the amount you actually pay counts toward this cap for generics - manufacturer discounts don’t count.

Can I switch plans if my generic gets moved to a higher tier?

Yes. Every fall, plans send out an Annual Notice of Change. If your generic moves to a more expensive tier or is removed, you can switch to a different Part D plan during the Annual Enrollment Period (October 15 to December 7) without penalty.

Do Medicare Part D plans cover all FDA-approved generics?

Most do, but not all. Plans can exclude generics that are used for weight loss, fertility, or cosmetic purposes. For other drugs, plans must cover at least 85% of generics in each therapeutic class, and 100% in six protected classes like antidepressants and antiretrovirals.

What’s the difference between a preferred and non-preferred generic?

Preferred generics (Tier 1) are the cheapest - often $0 to $15 per month. Non-preferred generics (Tier 2) cost more, usually $20 to $40 or a percentage of the drug’s price. Plans use this to encourage you to choose the most cost-effective option.

How do I find out if my generic is on my plan’s formulary?

Use the Medicare Plan Finder tool on Medicare.gov. Enter your exact medication names - including the generic version - and your zip code. It will show you which plans cover them and at what tier. You can also call your plan directly or check their website’s formulary section.

Astha Jain

January 19, 2026 at 07:21

so like… generics are just brand names but without the fancy packaging and the ads? i mean, why do they even bother with the tier system if they’re literally the same pill? my cousin in delhi takes the same atorvastatin as my uncle in texas and he pays 3 rupees. like… what even is this system??