Most people think pharmacies make big money on expensive brand-name drugs. But the truth? Generics are what keep most pharmacies open. You walk in, pick up a $4 prescription for metformin or lisinopril, and assume the pharmacy barely breaks even. You’d be wrong. They’re making more profit on that $4 pill than they are on a $500 brand-name drug-even though the brand costs ten times more. This isn’t a glitch. It’s the system.

Why Generics Are the Real Profit Engine

In the U.S., about 90% of all prescriptions filled are for generic drugs. But here’s the twist: those same generics make up less than 25% of total drug spending. The rest? Brand-name drugs. So why are pharmacies betting everything on the cheap stuff? Because the math doesn’t lie.

On average, pharmacies make a 42.7% gross margin on generics. For brand-name drugs? Just 3.5%. That’s not a typo. A $10 generic drug might cost the pharmacy $5.70 to buy. They sell it for $10. That’s $4.30 profit right there. A $500 brand drug? The pharmacy might pay $480 for it and sell it for $495. That’s $15 profit. Same number of pills. Same shelf space. But the generic gives you 28 times more profit per dollar spent.

It’s not magic. It’s how the system was built. When the Hatch-Waxman Act passed in 1984, it created a path for generic drugs to enter the market faster and cheaper. The idea was simple: more competition = lower prices. And it worked. But the profit shifted. Manufacturers didn’t make as much on generics, so they focused on high-priced brands. Pharmacies, though, got the opposite: low cost, high markup.

The Hidden Cost: How PBMs Squeeze Pharmacies

But here’s where it gets messy. That 42.7% gross margin? It’s not what ends up in the pharmacy owner’s pocket. Enter pharmacy benefit managers-PBMs. These are the middlemen between insurers, drug manufacturers, and pharmacies. They negotiate prices, set reimbursements, and control how much pharmacies actually get paid.

PBMs use something called “spread pricing.” They tell the insurance plan, “This drug costs $12.” They tell the pharmacy, “We’ll pay you $8.” They pocket the $4 difference. That’s spread. And it’s legal. In 2023, PBMs made four times more profit on generic drugs than on brand-name ones. That’s $32 out of every $100 spent on generics going to PBMs, not pharmacies.

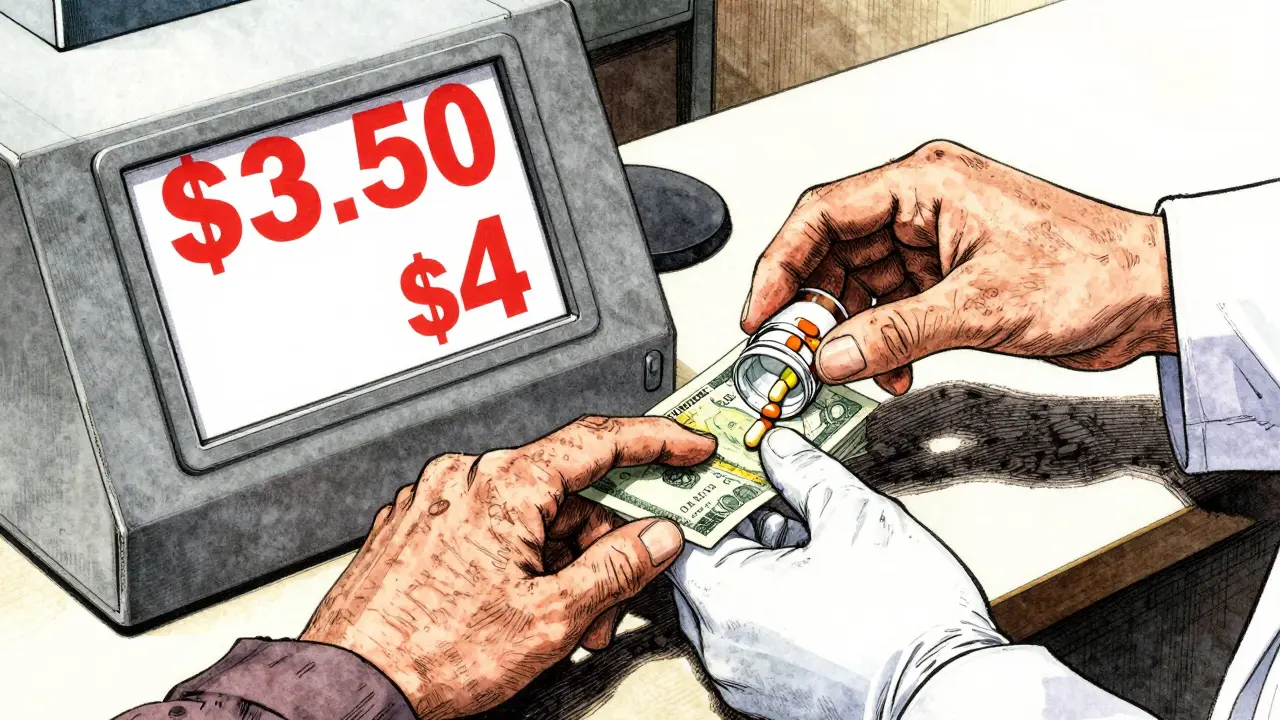

And then there’s clawbacks. You’ve probably seen the signs: “$4 generic.” But if the pharmacy gets reimbursed $3.50 by the PBM and the customer pays $4, the pharmacy keeps the $0.50. But if the PBM later says, “Wait, the real cost was $3.20,” they demand the extra $0.30 back. That’s a clawback. Independent pharmacies lose money on these transactions. Some say they’ve lost 30% of their generic revenue to clawbacks in the last five years.

Why Independent Pharmacies Are Dying

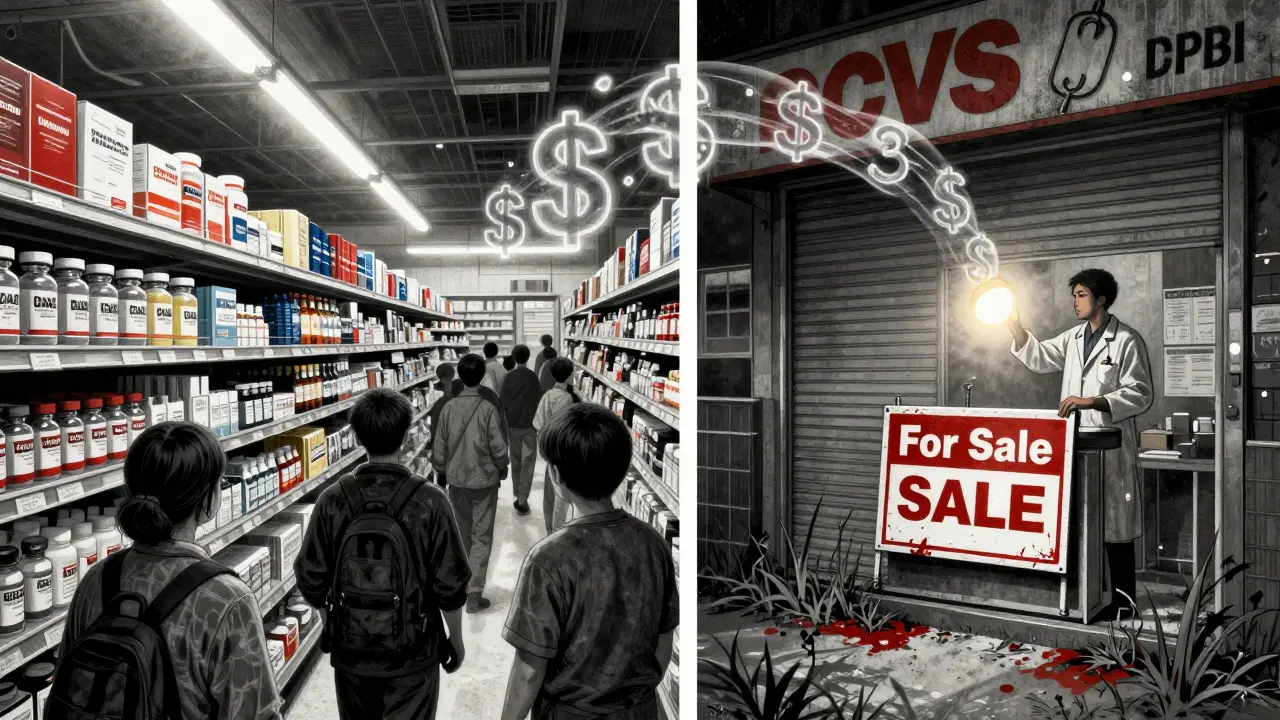

Between 2018 and 2023, over 3,000 independent pharmacies closed. Why? Because the margins are collapsing. Five years ago, many independents made 8-10% net profit on generics. Now? It’s 2%. Meanwhile, rent, staff wages, and insurance costs have gone up 35%. They’re working longer hours for less.

Big chains like CVS or Walgreens survive because they own their own PBMs. They control the pipeline. They get better rates. They can absorb the losses on generics because they make money elsewhere-on vaccines, lab tests, or in-store retail. Independent pharmacies don’t have that luxury.

And it’s getting worse. When a generic drug has only one manufacturer left-called a “single-source” generic-the price can skyrocket. No competition means no price pressure. In some cases, the generic now costs more than the brand. A 2024 white paper from SureCost found that for certain older generics, the price had jumped 400% in two years. Pharmacies had no choice but to charge more-or lose money.

How Some Pharmacies Are Fighting Back

Not all pharmacies are sitting still. A growing number are changing how they do business.

- Direct contracting: Some pharmacies skip PBMs entirely and bill employers or patients directly. This cuts out the middleman and gives them control over pricing.

- Cash-pay generics: Pharmacies like Mark Cuban’s Cost Plus Drug Company charge $20 for a 30-day supply of generic drugs, plus a $3 dispensing fee. Transparent. No spreads. No clawbacks. They’re processing over a million prescriptions a month.

- MTM services: Medication Therapy Management lets pharmacists consult with patients on their drug regimens. Medicare and some insurers pay for this service-$50 to $100 per visit. It’s not about pills anymore. It’s about expertise.

- Specialty pharmacy focus: Instead of fighting over $4 prescriptions, some pharmacies focus on complex, high-cost drugs for conditions like cancer or rheumatoid arthritis. These drugs come with built-in reimbursement structures and higher margins.

These aren’t just side hustles. They’re survival strategies. Pharmacies that added MTM services saw their net margins jump from 2% to 5% in under a year. That’s the difference between closing and staying open.

The Bigger Picture: Who Really Profits?

Let’s look at the full picture. When you spend $100 on a prescription:

- Manufacturer gets about $35 (mostly on brand drugs)

- PBM gets $32 (mostly on generics)

- Wholesaler gets $15

- Pharmacy gets $3

- The rest? Taxes, overhead, shipping, labor

That’s right. The pharmacy-the place you walk into, the person who hands you your pills-gets just $3. The PBM gets over 10 times more. And yet, pharmacies are the ones blamed for high drug prices.

It’s not the pharmacist raising prices. It’s the system. The same system that lets PBMs hide their pricing, that lets manufacturers raise prices without warning, that lets insurers shift costs to patients and pharmacies.

What’s Changing? And What’s Next?

There are signs of change. The FTC is investigating PBM practices. California, Texas, and Illinois have passed laws forcing PBMs to disclose their reimbursement formulas. The Inflation Reduction Act will let Medicare negotiate drug prices starting in 2026. That could lower overall spending-and indirectly ease pressure on pharmacies.

But the biggest shift might come from consumers. More people are asking: “How much does this drug actually cost?” Apps like GoodRx and services like Amazon Pharmacy are showing transparent pricing. People are starting to walk out of pharmacies when they see the real cost. And that’s forcing change.

Pharmacies that survive won’t be the ones with the biggest shelves. They’ll be the ones that adapt. That offer services. That build trust. That stop being just pill dispensers and become health partners.

The future of pharmacy isn’t about how many generics you sell. It’s about what you do with the time you save when you’re not chasing clawbacks and spreads. That’s the real profit.

Why do pharmacies make more profit on cheap generics than expensive brand-name drugs?

Pharmacies make more profit on generics because the cost to buy them is low, and reimbursement rates are set as a percentage of the drug’s price. For example, a $10 generic might cost the pharmacy $5.70, giving them a $4.30 gross profit (42.7%). A $500 brand drug might cost $480, leaving only $15 profit (3.5%). Even though the brand costs more, the percentage markup is tiny. Generics are volume-driven with high margins; brands are high-cost with low margins.

What role do PBMs play in pharmacy profit margins?

PBMs (pharmacy benefit managers) control how much pharmacies get paid for prescriptions. They use spread pricing-charging insurers more than they pay pharmacies-and clawbacks-demanding money back after payment. For generics, PBMs often make four times more profit than pharmacies do. This squeezes independent pharmacies, who have little negotiating power, and can turn a profitable sale into a loss.

Why are independent pharmacies closing faster than chain pharmacies?

Independent pharmacies lack the scale to negotiate better reimbursement rates with PBMs. Chains often own their own PBMs or have exclusive contracts. Independents also face rising rent, staffing costs, and declining net margins-down to 2% on generics from 8-10% five years ago. Without diversifying into services like medication therapy management, they can’t survive the financial squeeze.

Can pharmacies make money without relying on generics?

Yes. Some are shifting to Medication Therapy Management (MTM), where pharmacists consult patients on drug regimens and get paid $50-$100 per visit. Others focus on specialty drugs for complex conditions, which come with higher reimbursement. Some bypass PBMs entirely by offering cash-pay models (like Cost Plus Drug Company) or contracting directly with employers. These models can boost net margins to 4-6%.

Is the generic drug market becoming less competitive?

Yes. Between 2015 and 2023, the top five generic manufacturers went from controlling 32% of the market to 45%. Fewer manufacturers mean less competition, which can lead to price spikes. Some generics now have only one manufacturer-called single-source generics-and prices can jump 300-400%. The FTC has filed antitrust cases against manufacturers for price-fixing in these markets.

Darren Gormley

January 30, 2026 at 23:08

Bro, generics are the real MVP 🚀. You think you're saving money with brand names? Nah. You're just feeding the PBM machine. I once paid $3 for metformin and walked out with more profit than my crypto portfolio. 😂💸