Insurance Benefit Design: How Coverage Choices Impact Your Medication Access

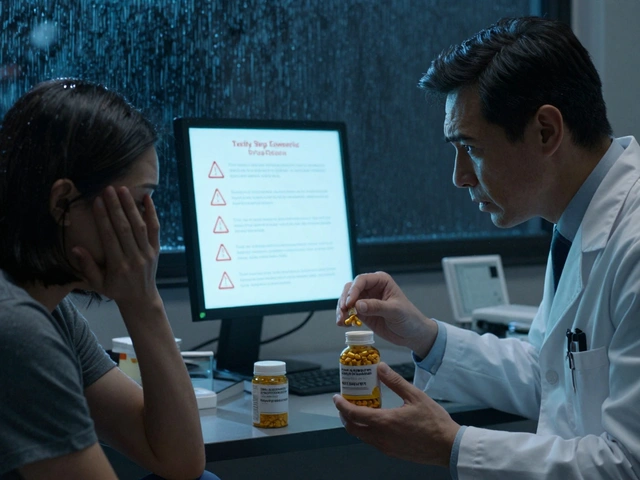

When you think about your prescription costs, you’re not just dealing with the price of the pill—you’re dealing with insurance benefit design, the structure health plans use to decide which drugs are covered, at what cost, and under what rules. Also known as pharmacy benefits design, it controls everything from your copay to whether your doctor can even prescribe a certain drug. This isn’t just paperwork—it’s the invisible gatekeeper between you and the medication you need.

Think about how your plan handles generics. Some plans force you to try the cheapest version first, even if it didn’t work for you before. Others charge you more for a brand-name drug unless your doctor jumps through hoops to prove you need it. That’s drug coverage, the specific rules that determine which medications are included in a health plan’s formulary. And it’s not random. Plans use health plan design, the overall framework that sets cost-sharing, prior authorization rules, and step therapy requirements to control spending. But that often means people delay or skip meds because the system makes it harder to get them—even if those drugs are medically necessary.

It’s not just about price. If your plan doesn’t cover a drug because it’s on a restricted list, your doctor might have to file a prior authorization. That can take days. For someone with GERD, a delay in getting vonoprazan could mean weeks of pain. For someone on multiple sedatives, missing a refill could mean dangerous withdrawal. And when medication shortages hit—like with antibiotics or insulin—pharmacy benefits, the system that manages how drugs are selected, priced, and distributed under insurance plans becomes even more critical. Who gets the limited supply? Who doesn’t? The answer often lies in how the benefit design prioritizes cost over clinical need.

These aren’t theoretical issues. They show up in real stories: the diabetic patient whose insulin was switched to a cheaper generic that didn’t work, the asthma patient who couldn’t get their preferred inhaler because it wasn’t on the formulary, the person with depression who couldn’t get their SSRI because their plan required trying a different drug first. The posts below dig into exactly these kinds of problems—how drug interactions, generic substitutions, shortages, and labeling gaps all tie back to how insurance plans are built. You’ll find real advice on navigating prior auth, understanding formularies, and pushing back when your coverage blocks care. This isn’t about guessing what your plan will do. It’s about understanding how it works—and what you can do about it.

Insurance Benefit Design: How Health Plans Use Generics to Cut Costs

Health plans use tiered formularies, mandatory substitutions, and step therapy to push patients toward generic drugs-saving billions while cutting patient costs. But hidden pricing practices can leave you paying more than you should.

About

Medications

Latest Posts

Future Anti-Counterfeit Technologies: How New Innovations Are Stopping Fake Drugs

By Orion Kingsworth Jan 22, 2026

Acromegaly Self‑Care: Essential Tips for Better Management

By Orion Kingsworth Oct 23, 2025

Computer Vision Syndrome: Proven Ways to Prevent Digital Eye Strain

By Orion Kingsworth Dec 15, 2025